On January 22, 2026, the global financial landscape shifted as reports confirmed that Elon Musk’s SpaceX has officially lined up four of Wall Street’s most powerful investment banks to lead its highly anticipated Initial Public Offering (IPO). Morgan Stanley, Goldman Sachs, JPMorgan Chase, and Bank of America have been selected to spearhead a listing that insiders believe could value the aerospace giant at a staggering $1.5 trillion. If successful, this "mega-IPO" would not only be the largest in history but would also mark the first time a "hectocorn"—a private company valued over $100 billion—debuts with a trillion-dollar price tag.

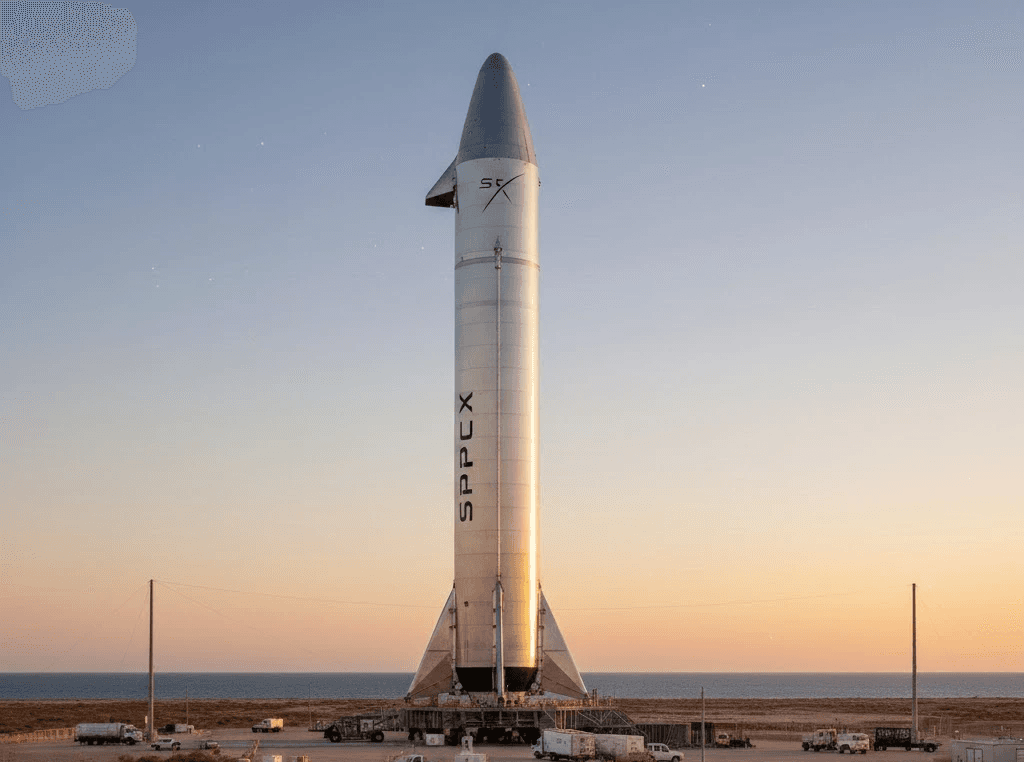

The move comes at a pivotal moment for the California-based company. For years, Musk resisted taking SpaceX public, citing the "onerous" quarterly reporting requirements that might interfere with his long-term mission of colonizing Mars. However, the explosive growth of Starlink, which reportedly generated over $6.6 billion in revenue last year, has transformed the company from a speculative rocket venture into a cash-flow powerhouse. Analysts suggest that the IPO will likely include the entire SpaceX entity rather than a Starlink spin-off, providing investors a unique blend of stable satellite internet dividends and high-risk Starship exploration.

Market experts are calling 2026 the "Year of the Hectocorn," as SpaceX's announcement coincides with potential listings from AI titans like OpenAI and Anthropic. The presence of these "monster IPOs" is seen as a litmus test for the global economy's appetite for high-growth tech. By tapping four major banks, SpaceX is ensuring a massive distribution network and deep institutional support. Morgan Stanley, in particular, is rumored to have an edge for the "lead left" role due to its decades-long relationship with Musk and its history of advising on Tesla’s complex financing.

One of the most intriguing aspects of the 2026 roadmap is how the IPO proceeds will be utilized. Musk recently hinted at the World Economic Forum in Davos that SpaceX is eyeing a new frontier: orbital AI data centers. By placing solar-powered server farms in low-Earth orbit, SpaceX could bypass traditional cooling and land-use constraints on Earth. This "Space Data" strategy, powered by the unmatched launch capacity of the Starship rocket, is a key pillar of the $1.5 trillion valuation that banks are now pitching to big-ticket investors.

Despite the excitement, the path to Wall Street remains fraught with complexity. A $1.5 trillion valuation is nearly double the company's recent private market valuation of $800 billion. To justify this "space-high" premium, SpaceX will need to hit several critical milestones in the coming months, including the successful orbital refueling of Starship and continued subscriber growth for Starlink in enterprise and military sectors. Furthermore, the company has reportedly entered a "quiet period" as of December 2025, a regulatory signal that formal filings with the SEC could be imminent.

The financial implications of this deal extend far beyond SpaceX itself. Underwriting fees for the four banks could total hundreds of millions of dollars, making it the most lucrative mandate of the decade. Additionally, a successful launch is expected to act as a "valuation anchor" for the entire aerospace sector. Peers like Rocket Lab and Planet Labs saw their shares tick upward on the news, as the SpaceX IPO is expected to draw billions in new capital toward the burgeoning space economy.

As the world watches the countdown to the mid-2026 launch window, one thing is certain: the SpaceX IPO is more than just a stock market event—it is a bid to fund the future of human multi-planetary life. Whether the market can support a trillion-dollar debut remains to be seen, but with Wall Street’s biggest names now at the helm, the mission has officially left the launchpad. The finalized prospectus and consolidated 2025 financial statements are expected to be the most downloaded documents in financial history when they finally drop.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.